The next Dumb Idea you hope will die.

GCR, [6/18/2022 10:37 AM]

we already had this mini personal token wave in 2020 with tokens like $ALEX/$JULIEN on tryroll; you might think, ok, it was a dumb idea, it didnt work, no one cared; "human IPOs"

GCR, [6/18/2022 10:38 AM]

but if you look at every bubble like nfts, there was also a failed "test run" mini cycle years before

GCR, [6/18/2022 10:38 AM]

for example, the aborted 2017-2018 nft wave that never got traction; was just a canary in the coal mine for 2020-2021

Triggered

I think it’s worth exploring this a bit more now that many bull market ideas are being trashed. The primary ingredients are a triggering idea, combined with a short, possibly failed first run. Even better if the people being triggered are smart. Here are some current areas of interest:

X to Earn

In January 2019 I interviewed Duncan Cockfoster on the Farsight Podcast about his new NFT exchange Niftygateway. ICO mania had collapsed and Cryptokittes were being derided.

To prepare for the interview, I bought and NFT from the only project I had heard of on the platform, an ‘Axie Infinity Mystic Box’ for $106. I got the email below and forgot about it for a while.

Mystic land, which was part of the box, eventually topped out at $80k. There was a lot of luck in this purchase, I didn’t sell the top and I bought lots of other NFTs in 2019 that went nowhere. But the level of confidence amongst NFT critics at the time was encouraging. We are seeing that again now.

The second chance to get in on Axie came when Delphi Digital started sharing that, the combination of the Ronin chain, play to earn and newly motivated emerging market of players in the Philippines meant that user numbers were skyrocketing. The Axie team shared a weekly excel sheet that was parabolic. But the most fundamental thing for me was that the clear growth was being ignored, shorted or derided on CT.

Ponzi or fruitful labor?

Nic Carter discussing Axie on Odd Lots: “Not only is this a ponzi like system that is pretty obviously going to fail because nobody plays the game for any other reason than the token dynamics, it had this nasty colonial vibe to it and ended up causing a lot of real world damage to people who couldn’t afford it…. In my view it was a from of digital sharecropping. They couldn’t enjoy the fruits of their labor “

The subsequent decline of Axie, Stepn and Jewel have led to some of the easiest dunks in this bear market. So is play to earn dead?

Most people would agree that incentivising physical activity, without forcing it, is a good thing. Now sprinkle on some web3 and they change their mind or even attack the idea. The primary criticism is the incentives can’t be aligned with a token. Maybe that has been true so far.

Governments using tax money to build public exercise areas and cycle lanes is no longer controversial. It’s probably too early for most governments to get on board with this incentivization format due to the risks for the average user, but I could see bigger companies adding us to the corporate wellness programs as an option.

Music NFTs/DAOs

“[paraphrasing] The wisdom of crowds is not effective for InvestmentDAOs. You need to be contrarian and patient. But, music super fans can serve as talent scouts for musicians and share upside with the artist..…… The current size of the music market is tiny compared to its cultural impact and it’s mostly due to record companies being trapped in an old model.”

I have no idea if MusicDAOS or Music NFTs will take off, but it has the right ingredients to create max salt among naysayers.

NFT.nyc 2022 showed the appetite among big music artists (Snoop, Madonna, Pink) to test NFTs as a sort of access, loyalty and merch tool. Is that the end of it?

Marshmello’s virtual Fortnite concert in 2021 to 10m+ concurrent users was an inflection point. The fact that Travis Scott followed up with bigger numbers opened up the trend. Whether it translates to ‘Metaverse events’ is anyone's guess. I’ve seen smart people dismissing the whole area so I’m paying attention to early experiments.

Mortgages on the blockchain

Below is a Reddit response to Packy McCormack not being able to explain why blockchain Mortgages are needed:

Alternative view

With hindsight bias, if I were Packy I would have said the following:

Agree with the host that the public record element was the main benefit, and that this would just create a more open system. Might not be groundbreaking but unlikely to be worse.

Speculate that transparency and composability in Real Estate might lead to experiments that we can't predict. Similar to how smartphones and GPSs led to unpredictable new apps.

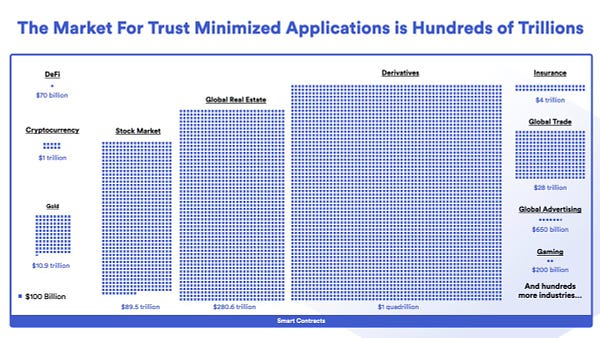

Real world assert (RWAs) are a nocoiner favorite dunk which makes me optimistic that something strange will catch on in this area. I don’t have any strong convictions yet. RWA potential:

Metaverse consultancy boom

Is there a more triggering combo of words than this? Metakey, PangeaDAO and Raoul Pal’s new venture are trying to help web2 companies dip their toe in the web3 water. Most of it will probably be a waste, partly because they will be too conservative, but if one of them gains traction in some area, the other web2 giants will follow suit quickly. I was fairly triggered by this initially but having some contact with PangeaDAO founders has changed my view.

Uncollateralized stablecoins

I agree with Tushar here but also think it will fall on deaf ears.

Every time uncollateralized stablecoins are brought up, industry leaders solemnly say; “I hope we’ve learned from our mistakes this time”. Ignoring the fact that throughout history, the right to print money has always been irresistible, and it will probably rise in some other form.

Hoping that UST was the last uncollateralized stable coin is the same as saying ‘this time it’s different’. Maybe it skips a cycle but it will be back. Each time it gets dressed up as something else.

20/3/23 UPDATE: Had add this Tweet in:

Privacy goes institutional and backfires

Nansen, Dune and Chainalysys have done well highlighting public transactions for 3rd parties. But institutions are actively looking for a way to keep their transactions private as is standard in Tradfi.

Teams like Railgun, Aztec and Starkware are attempting to bring privacy to this area with Zero knowledge proofs. I’m not technical enough to predict which project has the best chance of gaining traction here. I suspect the first application that allows institutions to privately attest to their transactions at scale will do well, irrespective of whether value can accrue to the token long term.

But like any exciting new trend it will allow for abuse, and we might all eventually curse the ease at which the institutions kept too much private and repeated some version of 2008, privately, onchain. This is followed by on chain privacy regulations and standards. And on to the next cycle.

CeFI distracts everyone

A more transparent version of Blockfi, Celsius and Voyager will likely eventually emerge and it will be closer to a bank, maybe with collateral more publicly posted. Likely to be boring and better regulated. CT will obsess over it due to recency bias. I’m dreading the endless regulatory debate. In the meantime, the real blowup risk moves somewhere else like leveraged metaverse land or private transactions for institutions.

ENS as the social layer?

If we go back to GCRs idea at the start and assume that social tokens will work but might come from unexpected places. Could ENS already be leading this? Could Dot Coms, with Avatars and bank accounts really be enough? I don’t know, but it would certainly be triggering for non ETH people to accept this.

Conclusion

Cryptokitties were widely derided in 2017 before punks took off. Solana was written off by most .ETH people in 2018. SNX rode the ICO bust all the way down before recovering. Many such cases.

This isn’t a new idea, but I think being able to find smart detractors with a potential blind spot is actually the best leading indicator in crypto after developer adoption. Maxis and stubborn nocoiners will never buy your bags. But partially biased people who are open to crypto might, once they see a trend is really building momentum.

This is particularly true of OG's, who did well in a particular area and are anchored to it as the future. It’s only when the trend is irrefutable that they will face up to the new reality.

In 2019, I interviewed the YGG, Opensea, NFT.nyc, 0x and Decentraland founders on the basis that they were ideas that had shown some traction, but failed to take off yet and were now being dismissed. The founders also seemed resilient. I regret not persisting with that instinct.

As things took off in 2020 I missed good oops for two reasons:

I thought it wouldn’t catch on and it didn’t fully, but still pumped (OHM, alt L1 trade, Sandbox)

I hoped it wouldn’t catch on because I thought it was dumb ( Bored Apes, Stepn)

If 2018/9 was about being early and patient. 2020/1 was about reacting quickly to new narratives. From Defi summer to the eventual Fed pivot.

As long as crypto isn’t dead, it’s probably now about being early and patient again.

Packy McCormack has good list of future use case that they are funding. I was triggered by a number of them, which was the catalyst for this essay. I think it’s worth adding to Chris Dixons, ‘the next big thing will look like a toy article’ and add that the next big thing will look like a toy, that you wished would go away.