A change in the tide for Bitcoin

A few unusual factors lead me to believe the bottom might be in for Bitcoin. When compared to Gold, SPX and M2, Bitcoin has touched off the previous high in 2017. Raoul Pal has identified the FED balance sheet as the numerator to watch in markets. Maybe USD is the wrong metric for Bitcoin TA? Thread below.

John Bollinger, who correctly called the three drives pattern that marked the top has highlighted a potential bottom.

Sam from FTX sees a potential bottom. One of the top 5 traders in crypto IMO.

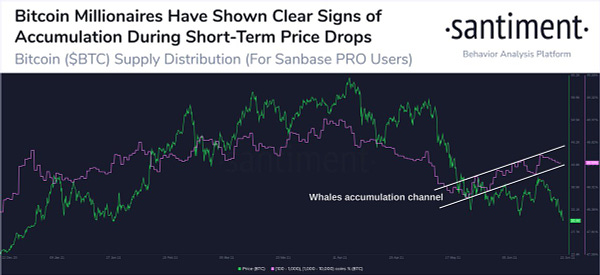

Santiment confirm that large BTC wallets continue to accumulate

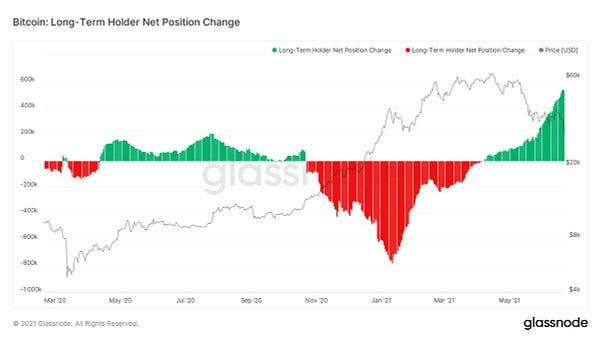

Glassnode founders corroborate this.

Will Clemente and Willy Woo add to this (take with a pinch of salt as they are almost always bullish)

A return to max fear yesterday after peak mining FUD feels like it may be the beginning of a turn up. My feed certainly panicked yesterday, with bear market calls everywhere.

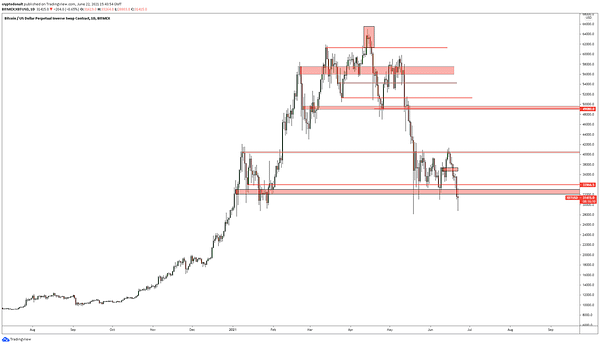

Cryptodonalt is looking for a close above 34k to get involved.

$BTC update: Bounced a lil, still the same Close above $34k and I'll start buying for the short squeeze, anything below has me uninterested Glad there is some energy in this thing left overall

$BTC update: Bounced a lil, still the same Close above $34k and I'll start buying for the short squeeze, anything below has me uninterested Glad there is some energy in this thing left overall

Markets like regulatory clarity. Or to put it more simply:

Conclusion

I’m wary of on chain metrics but there is something more significant about BTC, measured in Gold, SPX or M2 at significant levels. Let’s see if it holds up. I’m long Bitcoin for now. I’ll also be looking for anything that is outperforming Bitcoin, particularly Defi projects.